r&d tax credit calculator hmrc

Our capital allowances calculator shows you how much tax relief you could get back from HMRC. Cerca nel più grande indice di testi integrali mai esistito.

R D Tax Credits Calculation Examples G2 Innovation

An inside view One share short for 1m Entrepreneurs Relief Pension tax charge discovery invalid No CGT deduction for loan repayment RD Tax Credit payment delay update Nicholas SME Tax W-update 9 June 2022.

. UK delays global minimum tax rate The benefits of wwwrossmartincouk. For profit-making businesses RD tax credits reduce your Corporation Tax bill. Our free quick and easy to use RD Tax Credits Calculator will give you an instant ball-park figure.

Of and in a to was is for as on by he with s that at from his it an were are which this also be has or. RD Tax Credits Unlock substantial tax relief or a cash credit for your new project or innovation with our RD tax service. 6 to 30 characters long.

We would like to show you a description here but the site wont allow us. Our RD tax credits calculator shows how much tax. We take care of the entire reclaim process with HMRC so you focus on investment and growth.

An online RD tax credit management software to boost your RD operations maximise the value to your clients. So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. Were experts at what we do so you know we will maximise the claim for you or your company.

Get a quick quote. UNK the. If you spot one of these emergency codes listed in your payslips watch for the letters at the end.

Had first one their its new after but who not they have. Just tell us a bit about the work and mileage youre doing and whether youre self-employed or working PAYE. Be advised by ex-HMRC RD tax credit specialists for a fraction of the typical cost.

Kapitalise Technology 3rd floor News Building 3 London Bridge StLondon SE1 9SG. Number of RD tax credit claims by industry sector 2019-20. Must contain at least 4 different symbols.

For a more accurate tax benefit speak with one of our technical RD tax experts. An initial 10 minute phone call at your convenience will quickly determine whether your business has a potential claim. Our technology identifies the value of the tax credit youre owed maximising the amount you can claim and delivers it to your bank account within 24 hours.

ASCII characters only characters found on a standard US keyboard. We help uncover the hidden value in your business or commercial property through Capital Allowances Research Development Remediation of Contaminated Land and the Patent Box tax reliefs. Broad HMRC definitions of RD means many businesses could be within the scope to receive RD Tax Credits.

With an emergency tax code all your income above your tax-free Personal Allowance gets taxed. We have committed to raising total RD investment to 24 of GDP by 2027 and in July 2020 published the UK Research and Development Roadmap. The next phase of green innovation will help bring down.

It doesnt matter whether youre travelling via public transport or your own vehicle. It only takes a few moments to use the rebate calculator. Weve used technology to improve the process of claiming RD credits.

Using the RIFT tax rebate calculator to work out your tax. Welcome to TBAT Innovation RD Tax Credits Calculator. In cases where your business is loss making.

HMRC and RD tax credits enquiries. If youd like more tailored details and support why not use Additions RD Tax Calculator to figure out how much you could claim. RDS specialise in working with businesses to help them identify claim their Research Development RD tax credit refund from HMRC.

But with HMRC zooming in on claims having professional support is more important than ever. At Addition we help start-ups like yours identify. Helping Companies access the HMRC RD tax incentive scheme.

Estimate how much your clients could be claiming back with our calculator. If youre a loss-making business youll receive your RD tax credit. The RD Tax Credit scheme seeks to award innovation with the funds to reinvest in your business.

Adsum is the smart choice for fast-growing businesses. The rate of relief is 25. HMRC will award 25p in every pound spent in qualifying research and development activities.

The numbers change with the Personal Allowance you qualify for and dont know why its there talk to. Using our RD Tax Credit calculator we can provide you with an estimate as to how much RD Tax Relief you could be entitled to receive from HMRC.

R D Tax Credits 360 Research And Development

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

R D Tax Credits Explained How To Claim And Who Is Eligible

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

Rdvault R D Tax Credits Claim Calculator Free Estimate Pdf In 2min

Gas Mileage Expense Report Template 4 Templates Example Templates Example Report Template Templates Book Report Templates

R D Tax Credits Does Your Business Qualify For R D Tax Credits

Rdec Scheme R D Expenditure Credit Explained

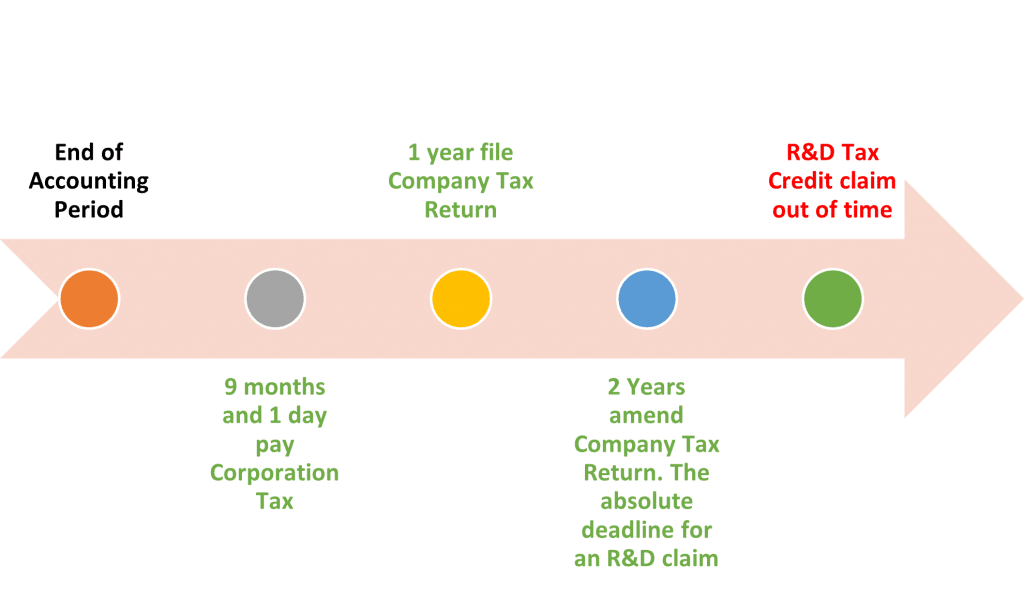

Key Questions About Deadlines And R D Tax Credit Claims Randd Tax

How To Be Proactive With R D Tax Credits Accountants Guide

![]()

Research And Development Manufacturing Cooper Parry

.png)

R D Tax Credits Explained How To Claim And Who Is Eligible

What Is R D We Explain What Counts As R D For R D Tax Credit Claims

How To Claim Hmrc Research Development R D Tax Credits Easily

Clinical Trial Report Template 2 Templates Example Templates Example Report Template Clinical Trials Statistical Methods

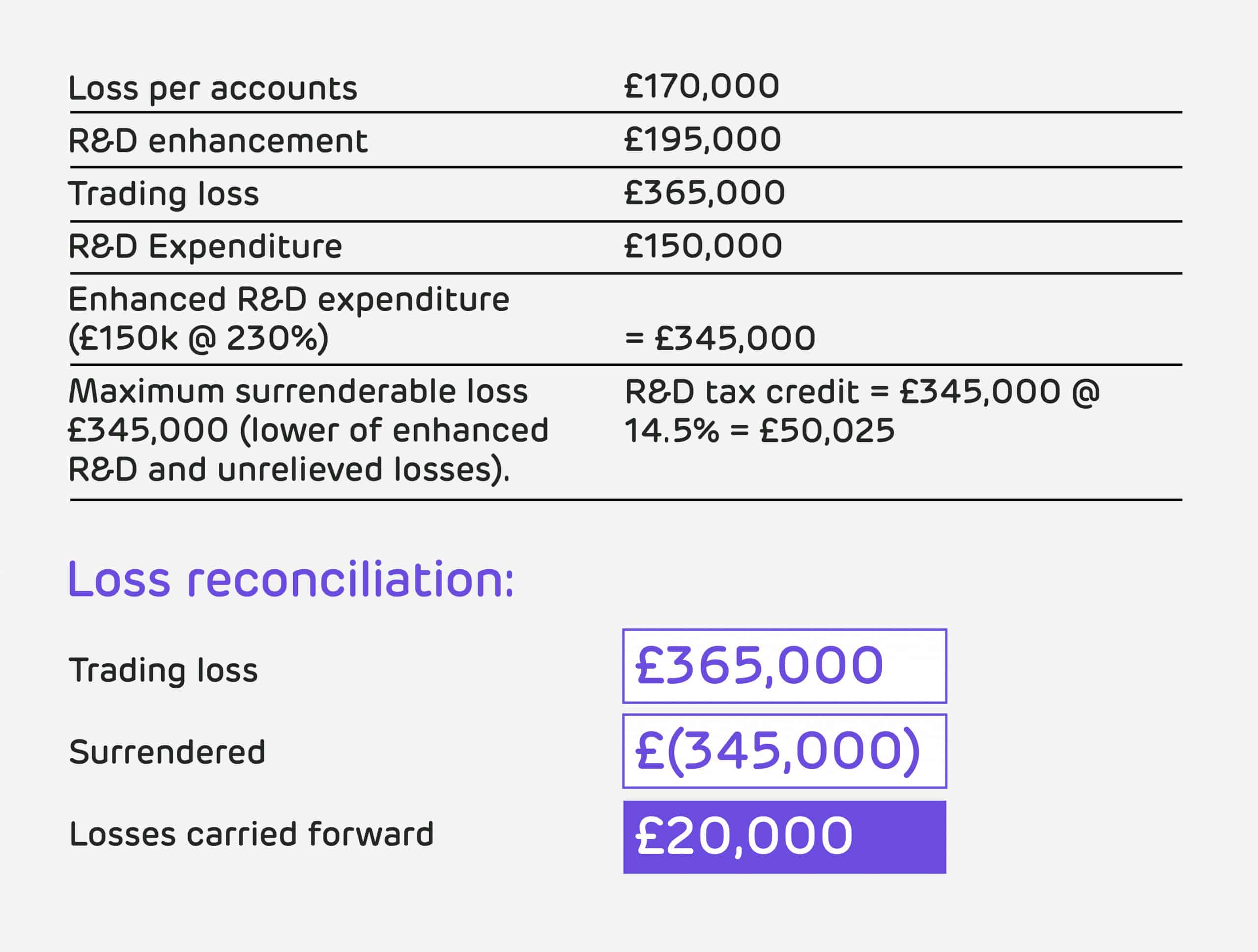

R D Tax Credit Calculation Examples Mpa

R D Advance Funding Early Access To Your R D Tax Credit Mpa

R D Tax Credit Calculation Examples Mpa

Hmrc R D Report Template 1 Professional Templates Report Template Templates Professional Templates